Boost Cash Flow with Invoice Factoring

Cash flow is the heartbeat of any business.. One of the biggest challenges for businesses is managing working capital while waiting for customers to pay their invoices. This is where invoice factoring comes in as a smart financial solution to maintain cash flow and fund day-to-day operations.

Offering credit is an excellent way to make your products and services more appealing, as it allows customers to pay at a later time. This practice is especially common for high-value purchases or those with long shipping times.

While large businesses can manage unpaid invoices without issue, small and midsize businesses often face cash flow challenges and can’t afford long payment delays. That’s where Big Brother Financial can help. By turning your unpaid invoices into immediate cash, you can keep up with operational expenses, boost production, and improve delivery times. Cash flow is essential for any business to stay competitive, and Big Brother Financial offers the support you need to maintain that edge.

What Is Invoice Factoring?

Invoice factoring for small and medium businesses (SMBs) is a financial solution that helps improve cash flow by converting unpaid invoices into immediate working capital. Rather than waiting 30, 60, or even 90 days for customers to pay, businesses can sell their outstanding invoices to an invoice factoring company in exchange for an upfront cash advance. This allows businesses to cover essential expenses such as payroll, inventory, fuel, or other operational costs without waiting for delayed payments.

Invoice factoring is a flexible option, especially for small and medium businesses that may struggle with long payment terms from customers. It’s a valuable tool to maintain liquidity, keep operations running smoothly, and avoid cash flow disruptions that can hurt growth. We offer invoice factoring for various industries like, Staffing Companies, Manufacturing Companies, Oil and Gas Companies, etc.

At Big Brother Financial, we understand the pressure and uncertainty that waiting for payments can cause—because we’ve been there too. It’s incredibly frustrating to wait on cash for work you’ve already completed, all while managing unpaid invoices. Many small and medium businesses are at the mercy of large companies that set extended payment terms, often 30, 60, or even 90 days. This delay creates numerous challenges for SMBs, including:

Making Payroll: Even if your customers haven’t paid yet, you still have financial obligations. Employees expect to be paid on time, and for many business owners, this creates significant stress when cash flow is tight.

Missing Growth Opportunities: Big opportunities require funding, whether it’s to hire more staff, purchase supplies, or invest in equipment. Without available cash, it’s tough to take on these projects and grow your business.

Limited Access to Traditional Financing: Banks often see small businesses as too risky, especially newer ones without a long financial track record or credit history. Even established businesses can face long approval times for loans or credit line increases, which may not meet urgent funding needs.

Difficulty Purchasing Supplies: Maintaining stock or taking advantage of bulk discounts can be hard when you’re waiting for payment. This can hurt your ability to fulfill orders and manage costs efficiently.

Increased Administrative Burden: Chasing down late payments eats into your time and resources. Instead of focusing on running and growing your business, you’re stuck making follow-up calls and sending reminders to clients.

How Does Invoice Factoring Work?

- Provide goods or services: Your business delivers goods or services to the customer as usual.

- Issue the invoice: You send an invoice to your customer, typically with 30 to 90-day payment terms.

- Sell the invoice: Instead of waiting for payment, you sell the invoice to a factoring company like Big Brother Financial, which specializes in invoice factoring for small businesses.

- Get a cash advance: The factoring company advances a percentage of the invoice value, giving you quick access to funds.

By partnering with Big Brother Financial, small and medium businesses can easily convert their accounts receivable into immediate cash, ensuring they have the liquidity to meet their day-to-day obligations. Invoice factoring provides not just cash flow relief but also the peace of mind to focus on growing the business rather than chasing payments.

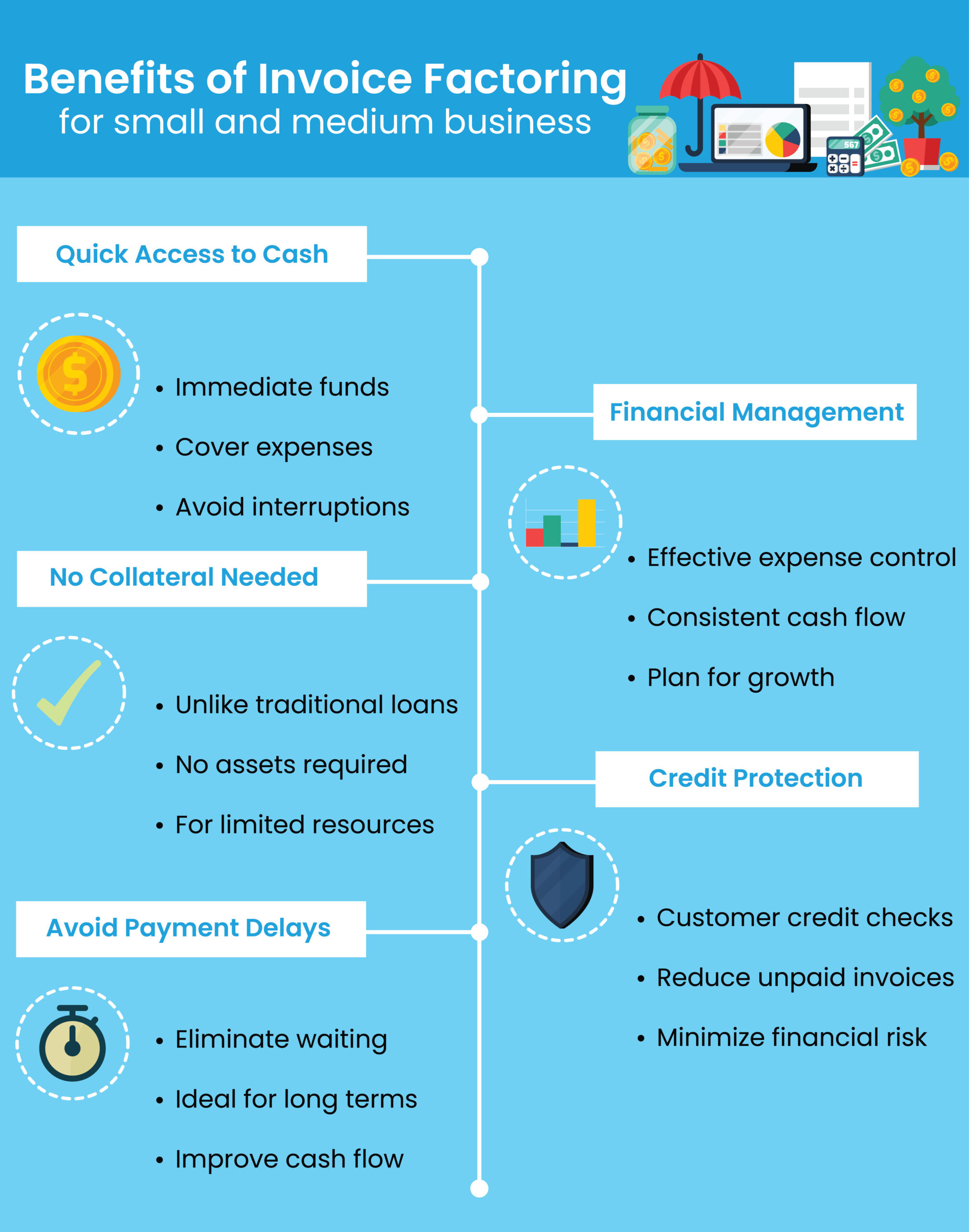

Benefits of Invoice Factoring for Small and Medium Businesses

- Quick Access to Cash: Factoring provides immediate funds, allowing SMBs to cover expenses without cash flow interruptions.

- Better Financial Management: With consistent cash flow, businesses can manage expenses more effectively and plan for growth.

- No Need for Collateral: Unlike traditional loans, invoice factoring doesn’t require assets or property as collateral, making it ideal for businesses with limited resources.

- Credit Protection: Many factoring companies offer credit checks on your customers, reducing the risk of unpaid invoices.

- Avoiding Long Payment Cycles: For industries with long payment terms, such as manufacturing, trucking, or staffing, factoring solutions eliminate the waiting for payment.

Is Invoice Factoring Right for Your Business?

If your business struggles with delayed payments or long payment terms from customers, invoice factoring could be the right solution to boost your working capital. Small and medium-sized businesses that experience seasonal fluctuations or rapid growth often turn to factoring to keep their operations running smoothly.